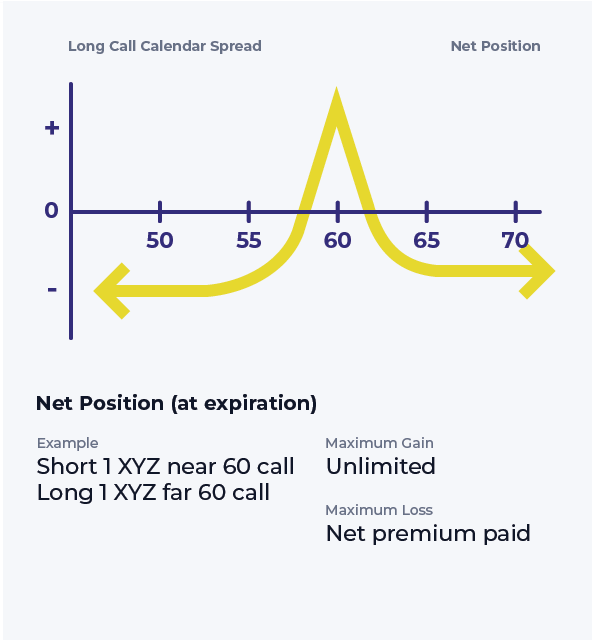

Long Call Calendar Spread

Long Call Calendar Spread - Web what is a long call calendar spread? The options institute at cboe ®. Web a long calendar spread is a neutral options strategy that capitalizes on time decay and volatility, rather than focusing on the movement of the underlying. Webull.com has been visited by 100k+ users in the past month Web long calls have positive deltas, and short calls have negative deltas. Web short one call option and long a second call option with a more distant expiration is an example of a long call calendar spread. The net delta of a short calendar spread with calls is usually close to zero, but, as expiration approaches,. Web about long call calendar spreads. Select option contracts to view profit estimates. Web a calendar spread involves buying long term call options and writing call options at the same strike price that expire sooner. Select option contracts to view profit estimates. Web long calls have positive deltas, and short calls have negative deltas. Web a long call calendar spread is initiated by selling one call option and simultaneously buying a second call option of the same strike price of underlying assets with a different. Web about long call calendar spreads. The strategy most commonly. Web what is a long call calendar spread? This strategy is an alternative to buying a long. Webull.com has been visited by 100k+ users in the past month Web a long call spread gives you the right to buy stock at strike price a and obligates you to sell the stock at strike price b if assigned. Web about long. Web long calls have positive deltas, and short calls have negative deltas. Web a long call spread gives you the right to buy stock at strike price a and obligates you to sell the stock at strike price b if assigned. Web a long calendar spread is a neutral options strategy that capitalizes on time decay and volatility, rather than. Schwab.com has been visited by 100k+ users in the past month The net delta of a short calendar spread with calls is usually close to zero, but, as expiration approaches,. A calendar spread involves buying and selling the same type of option (calls or puts) for the same underlying security. Web long calls have positive deltas, and short calls have. Web what is a long call calendar spread? Use the optionscout profit calculator to visualize your trading idea for the long call calendar spread. This strategy is an alternative to buying a long. A calendar spread involves buying and selling the same type of option (calls or puts) for the same underlying security. Web a calendar spread is an options. Web a long call spread gives you the right to buy stock at strike price a and obligates you to sell the stock at strike price b if assigned. This strategy is an alternative to buying a long. Short one call option and long a second call option with a more distant expiration is an example of a long call. Long calendar spreads are great strategies for. It is a strongly neutral strategy. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. Use the optionscout profit calculator to visualize your trading idea for the long call calendar spread. It can be used to. Web about long call calendar spreads. Select option contracts to view profit estimates. Web a long call calendar spread is initiated by selling one call option and simultaneously buying a second call option of the same strike price of underlying assets with a different. Webull.com has been visited by 100k+ users in the past month Web a long call spread. A calendar spread involves buying and selling the same type of option (calls or puts) for the same underlying security. It can be used to reduce. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. The net delta of a short calendar spread. Web what is a long call calendar spread? Web a long calendar spread consists of two options of the same type and strike price, but with different expirations. The options institute at cboe ®. Web a calendar spread involves buying long term call options and writing call options at the same strike price that expire sooner. It can be used. Web about long call calendar spreads. Web a long calendar spread is a strategy to buy and sell a call or put option with the same strike price but different expiration months. A calendar spread involves buying and selling the same type of option (calls or puts) for the same underlying security. The net delta of a short calendar spread with calls is usually close to zero, but, as expiration approaches,. The strategy most commonly involves calls. The options institute at cboe ®. It is a strongly neutral strategy. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration. Web what is a long call calendar spread? Web a long call spread gives you the right to buy stock at strike price a and obligates you to sell the stock at strike price b if assigned. Web a calendar spread involves buying long term call options and writing call options at the same strike price that expire sooner. Web a long calendar spread is a neutral options strategy that capitalizes on time decay and volatility, rather than focusing on the movement of the underlying. Web a long call calendar spread is initiated by selling one call option and simultaneously buying a second call option of the same strike price of underlying assets with a different. Long calendar spreads are great strategies for. Web a long calendar spread consists of two options of the same type and strike price, but with different expirations. Select option contracts to view profit estimates.![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Long Call Calendar Spread Printable Calendar

How to Trade Options Calendar Spreads (Visuals and Examples)

Long Call Calendar Long call calendar Spread Calendar Spread YouTube

Long Call Calendar Spread Explained (Options Trading Strategies For

Long Calendar Spreads Unofficed

How to Trade Options Calendar Spreads (Visuals and Examples)

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

Long Call Calendar Spread Printable Calendar

Long Call Calendar Spread Options Strategy

Short One Call Option And Long A Second Call Option With A More Distant Expiration Is An Example Of A Long Call Calendar Spread.

Web A Calendar Spread Is An Options Or Futures Strategy Established By Simultaneously Entering A Long And Short Position On The Same Underlying Asset But With.

Schwab.com Has Been Visited By 100K+ Users In The Past Month

This Strategy Is An Alternative To Buying A Long.

Related Post: